2025-11-22 14:19:48

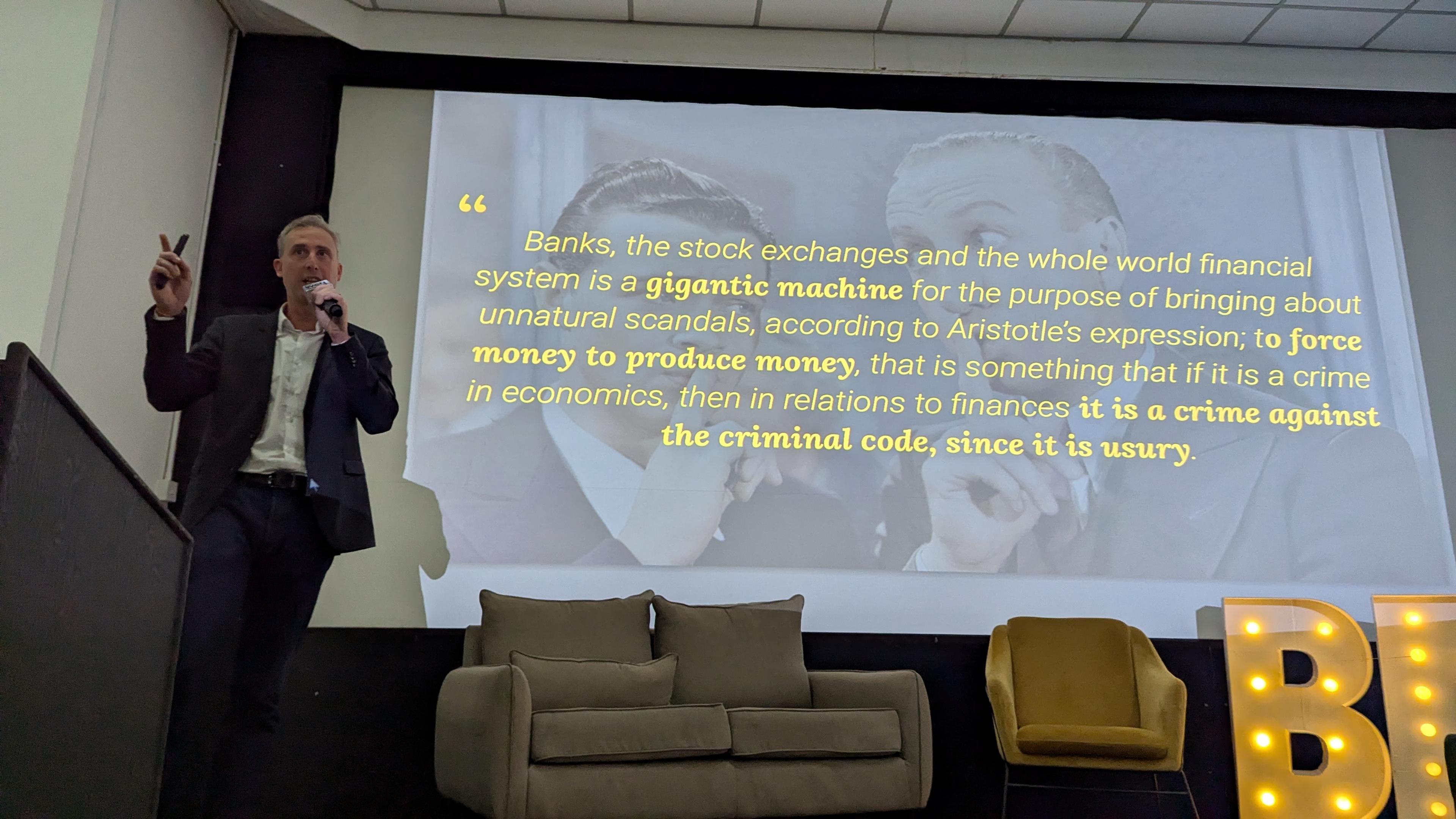

Prem ghinde thinks that Alan is killing bitcoin.

Alan is paid in government money, and saves in bitcoin. He's an imaginary straw man.

Alan doesn't plan to spend his bitcoin though. Just stack it until he sells it. And this doesn't build the bitcoin network.

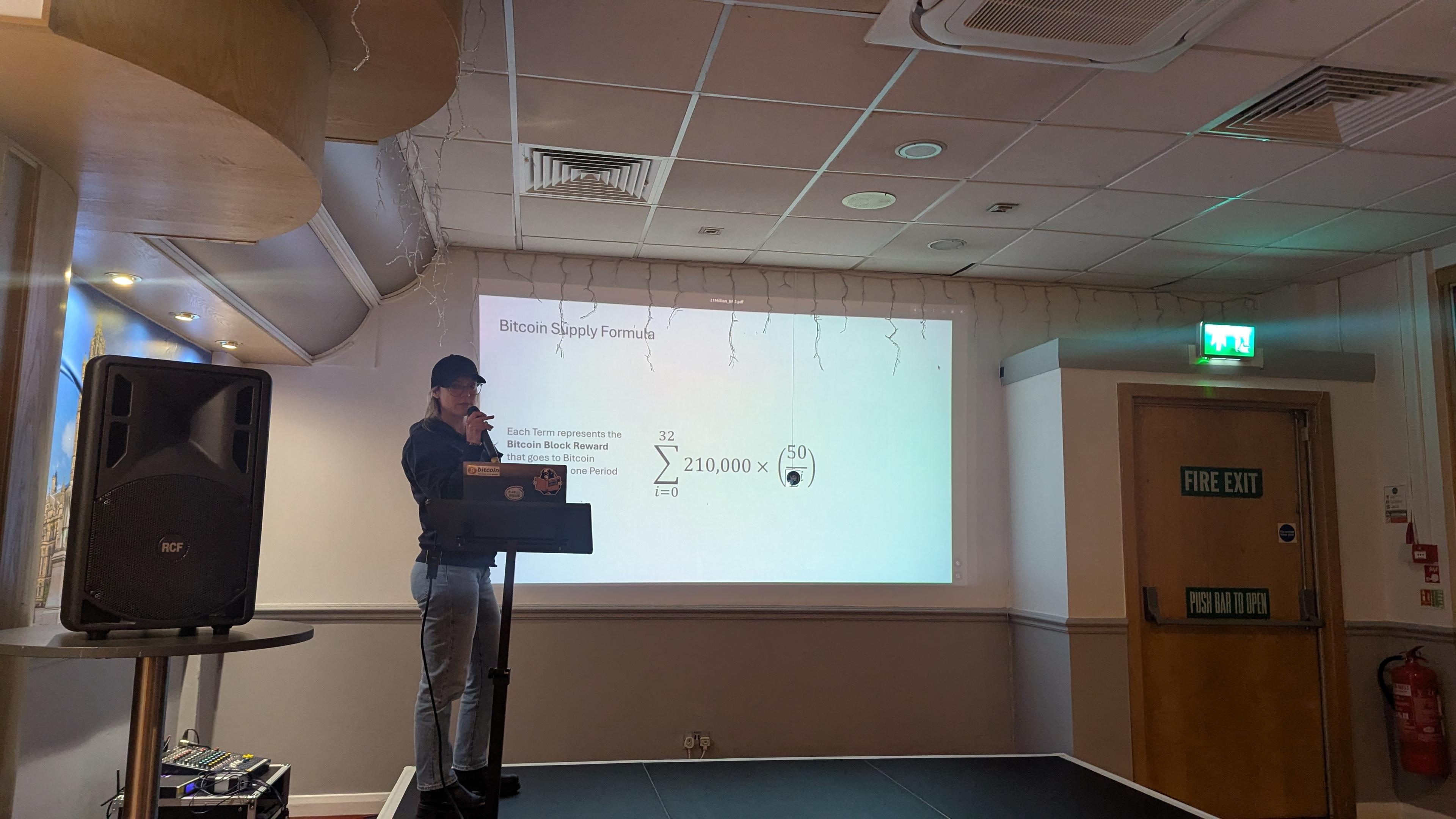

Without transitions, when the block rewards run out, there will be no money for miners. Miners will need fees, which means transactions.

Since he's paying in bank money, he's funding bankers instead of miners. He's encouraging retail to accept bank money instead of miners and lightning liquidity providers.

Unlike Alan, Prem lives on the bitcoin standard. All in. Spending sats because he has no bank money to spend. It can be done, he insists. Today. Mostly by using gift vouchers bought with bitcoin.

He's sad that people here are buying drinks from the hotel with bank cards instead of lightning.

Stop watching the price, he says, it's only a measure of government money's collapse. Change your yardstick. Account in bitcoin. Dollars aren't even money, they are currency. If you must measure, do it against gold.

Since moving to el Salvador he had learned Spanish, until he even dreams in Spanish. Try to dream in bitcoin.

Every transaction is a vote, so stop voting for bank money.

I think the main trouble with this is that tax event in every purchase, and the fact my employer won't set a wage in bitcoin even if they would convert to bitcoin to pay me.

#bitcoin #bitfest